|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

A Mixed Start to the Week for Grain Markets

Watch us on RFD-TV, today at 9:45am CT!

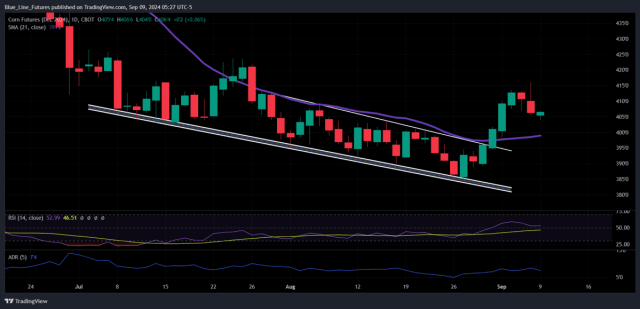

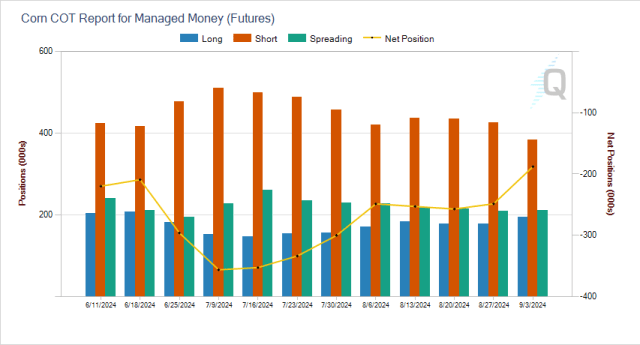

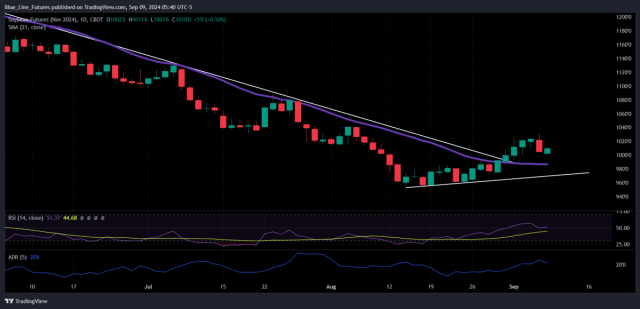

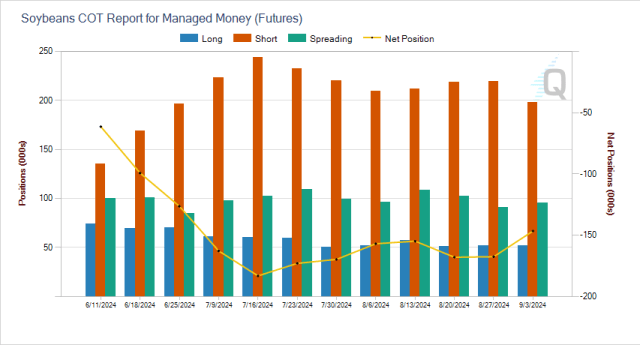

December corn futures made new highs for the move on Friday but reversed to finish roughly 10 cents off the high. That bearish reversal hasn’t materialized into much weakness to start the week as we’ve seen corn trade on both sides of unchanged in the overnight and early morning session. First support comes in from 401-403 3/4, this is what we would view as a “must hold” pocket for the Bulls. A break and close below there could start to neutralize some of the work that has been done over the last two weeks. On the resistance side of things, 413 1/2-416 is the first big hurdle. A move out above there and se could see another wave of short covering propel prices into the mid-420s. Short Term Bias and Technical Levels of Importance Below: Daily Chart of December Corn Futures.  Commitment of Traders Update  Soybeans November traded into our secondary resistance pocket (1031 3/4-1035) but fizzled out and reversed back lower, taking prices back to first support by the close, 1000-1006 1/2. This pocket will be key to start this week’s trade, a break and close below here could reignite technical selling pressure with little support until 984 3/4-991. Short Term Bias and Technical Levels of Importance Below: Daily Chart of November Soybean Futures  Commitment of Traders Update  Ready to dig in? Subscribe to our daily Grain Express for fresh insights into Soybeans, Wheat, and Corn. Get our expert technical analysis, proprietary trading levels, and actionable market bias delivered right to your inbox. Sign Up for Free Futures Market Research – Blue Line Futures Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results. On the date of publication, Oliver Sloup did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|